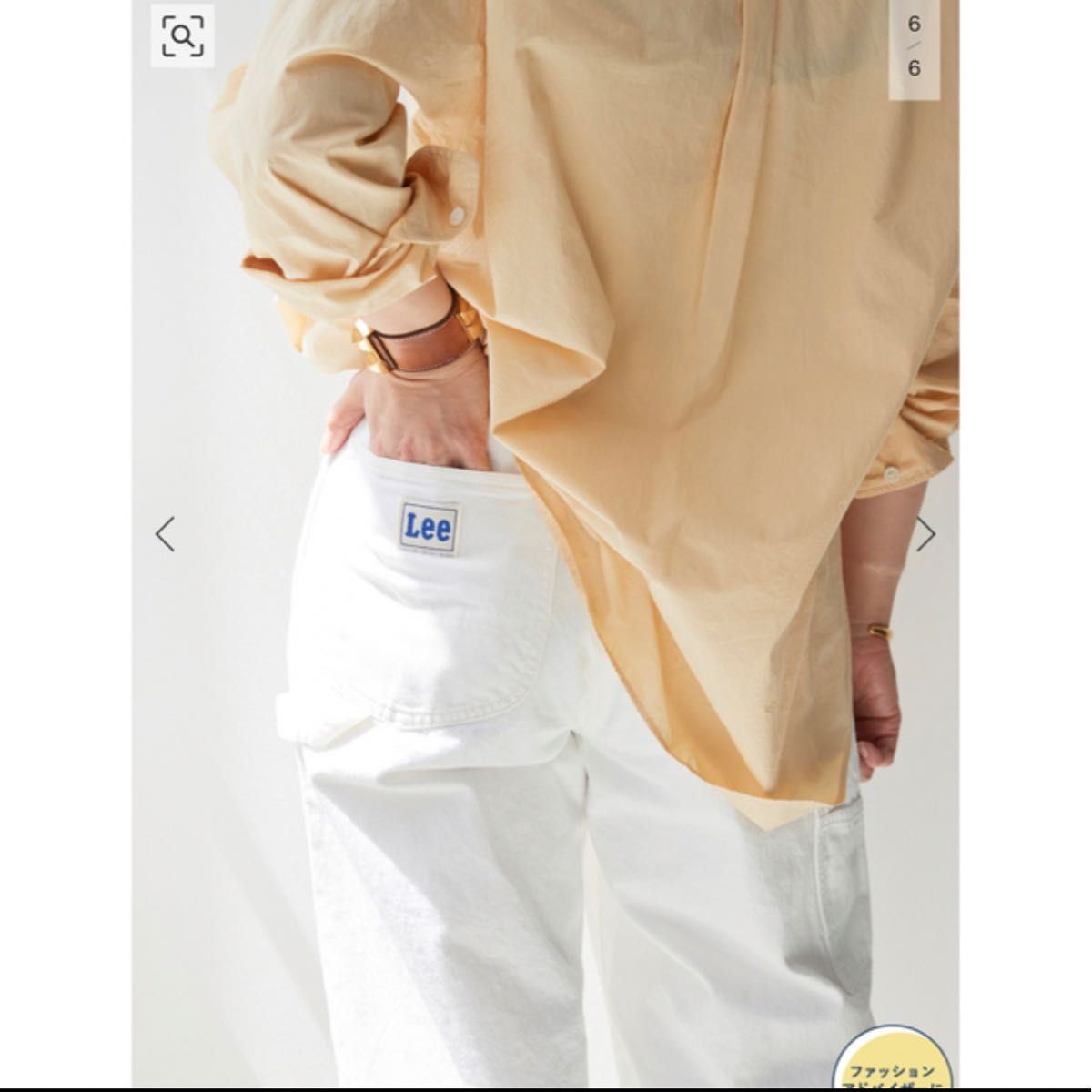

Deuxieme Classe Lee 別注ペインターデニム 34

(税込) 送料込み

商品の説明

Deuxieme Classe

Lee 別注ペインターデニム

*大変お手数でございますが、ご決済迄にお時間を要する場合にはお支払いご予定日をご一報下さいませ。

宜しくお願い致します。

ご覧頂きありがとうございます。

ご不明な点はお気軽にコメント下さいませ。

今季 新品 未使用 タグ付のお品物となります。

カラー:ブルー A

サイズ:34商品の情報

| カテゴリー | レディース > パンツ > デニム/ジーンズ |

|---|---|

| 商品のサイズ | S |

| ブランド | ドゥーズィエムクラス |

| 商品の状態 | 新品、未使用 |

Lee 別注 ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

DEUXIEME CLASSE - ☆Deuxieme Classe ☆Lee 別注 ペインターデニム 36

Deuxieme Classe Lee 別注 ペインターデニム 34 【2022春夏新作】 www

Lee painter デニム(デニムパンツ・ジーンズ)|Deuxieme Classe

☆10/3(火)夕方まで☆ Lee 別注ペインターデニム 34 セットアップ 51.0

新作からSALEアイテム等お得な商品満載 Deuxieme Classe Lee 別注

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注 ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee painter デニム(デニムパンツ)|Deuxieme Classe

DEUXIEME CLASSE - Deuxieme Classe Lee 別注 ペインターデニム 34の

Deuxieme Classe Lee 別注ペインターデニム 36 完売商品! 最安値に

Lee 別注 ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Deuxieme Classe Lee 別注 ペインターデニム 未使用 【爆買い!】 51.0

Lee 別注 ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

楽天市場】【中古】ドゥーズィエムクラス DEUXIEME CLASSE 23SS Lee

DEUXIEME CLASSE 2023SS Lee 別注 ペインターデニムパンツ【値下げ

Deuxieme Classe Lee 別注 ペインターデニム 34 リー 上質 zicosur.co

DEUXIEME CLASSE 2023SS Lee 別注 ペインターデニムパンツ【値下げ

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee painter デニム(デニムパンツ)|Deuxieme Classe

Lee painter デニム(デニムパンツ・ジーンズ)|Deuxieme Classe

DEUXIEME CLASSE - Deuxieme Classe Lee 別注 ペインターデニム 34の

DEUXIEME CLASSE 2023SS Lee 別注 ペインターデニムパンツ【値下げ

Lee 別注 ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee painter デニム(デニムパンツ・ジーンズ)|Deuxieme Classe

DEUXIEME CLASSE - ☆Deuxieme Classe ☆Lee 別注 ペインターデニム 36

Lee painter デニム(デニムパンツ・ジーンズ)|Deuxieme Classe

DEUXIEME CLASSE - SURT WIDE BAGGY デニム 38インチの通販 by y

Lee 別注ペインターデニム(デニムパンツ・ジーンズ)|Deuxieme

Lee 別注 デニム(デニムパンツ・ジーンズ)|Deuxieme Classe

Deuxieme Classe Lee 別注 ペインターデニム 34|PayPayフリマ

DEUXIEME CLASSE - Deuxieme Classe Lee 別注 ペインターデニム 34の

DEUXIEME CLASSE - ドゥーズィエムクラス デニムパンツ ジーンズ 34

Lee 別注 デニム(デニムパンツ・ジーンズ)|Deuxieme Classe

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています