美品!LINDBERG ◆ MDSCA デンマーク製

(税込) 送料込み

商品の説明

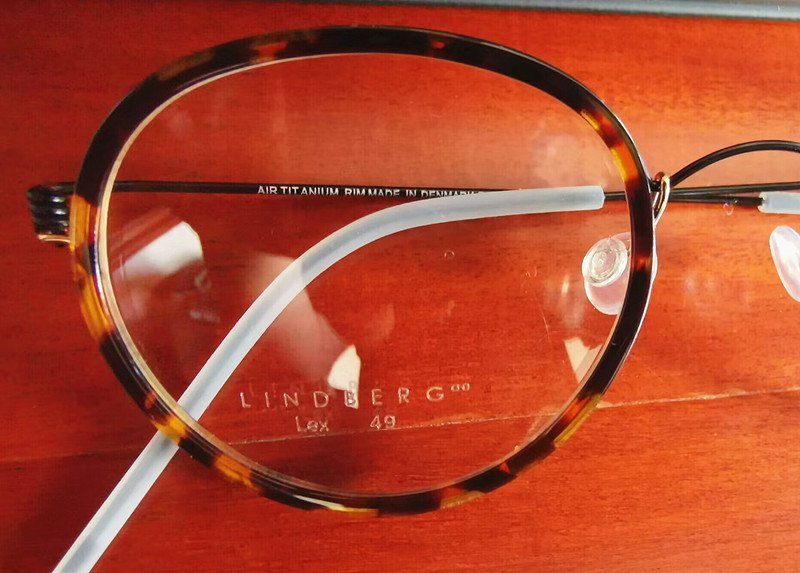

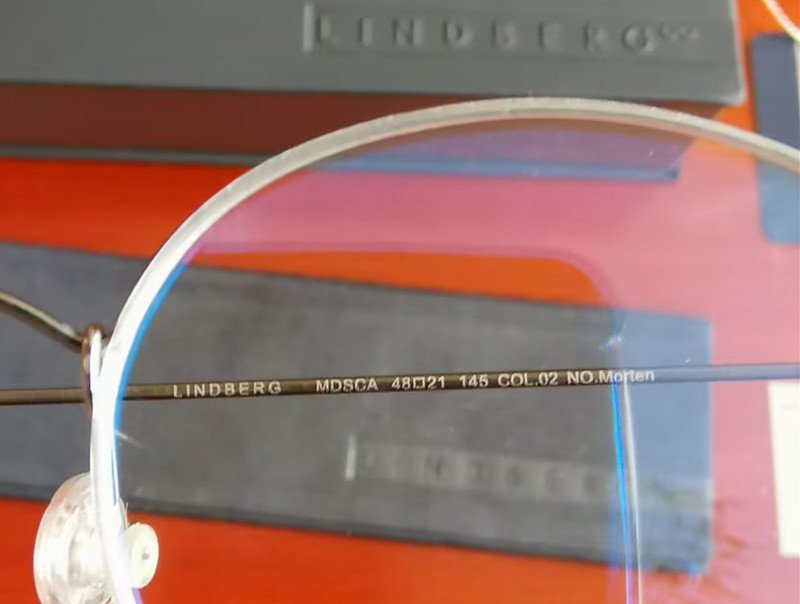

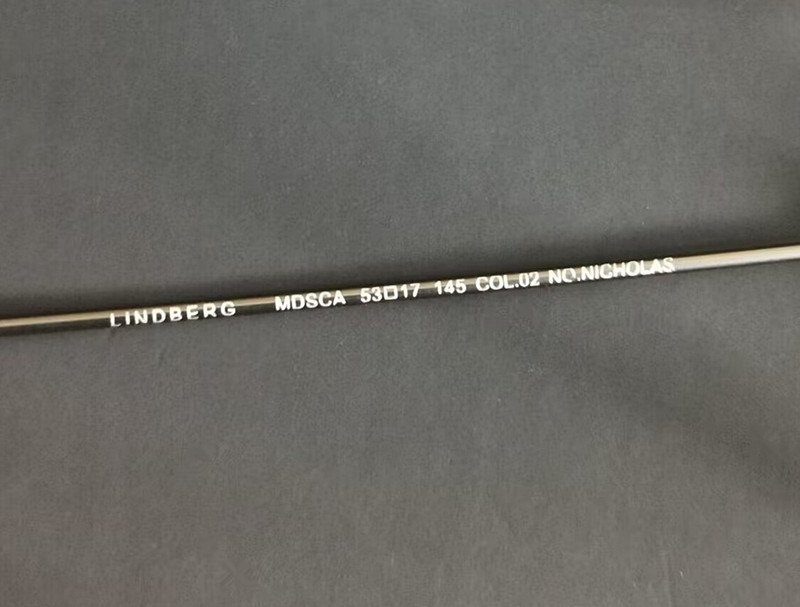

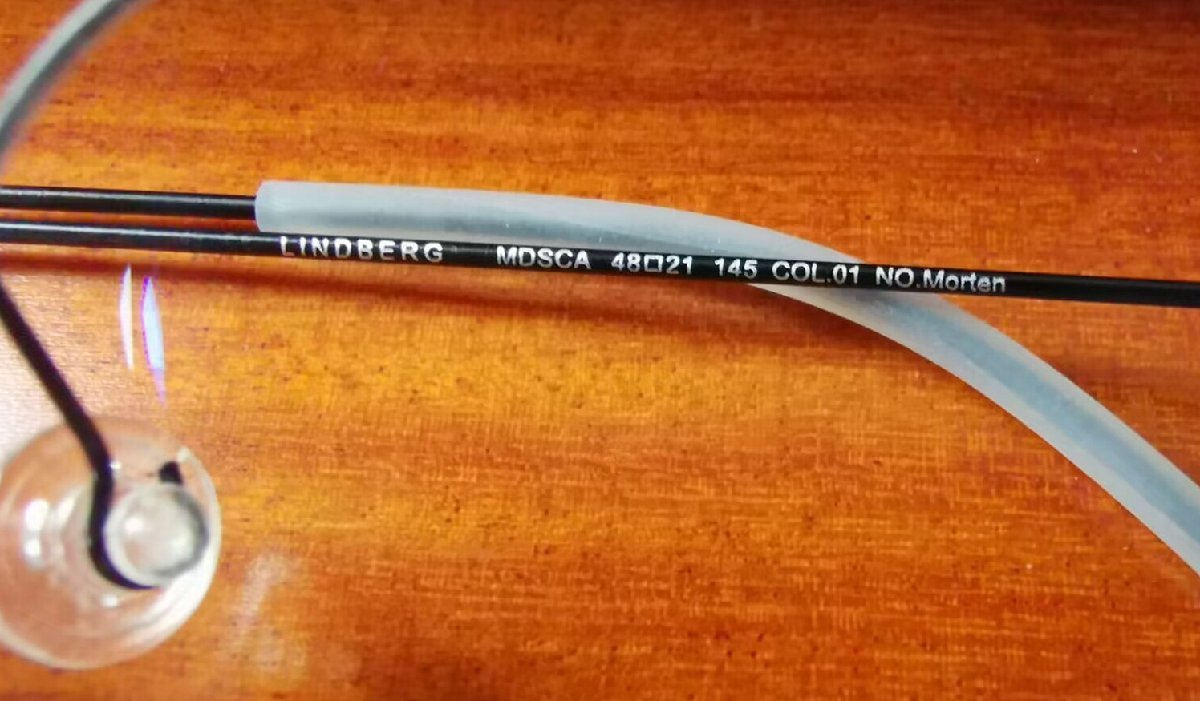

LINDBERG

MDSCA べっ甲

◇サイズ

レンズ縦 4.5

横 3.9

フレーム幅 13.5

テンプル 14.5

度入りレンズを入れていたので外しました。

フレームのみです。

1回

使用のみの、美品です。 定価70000商品の情報

| カテゴリー | メンズ > 小物 > サングラス/メガネ |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

美品!LINDBERG ◇ MDSCA デンマーク製-

美品!LINDBERG ◇ MDSCA デンマーク製-

美品!LINDBERG ◇ MDSCA デンマーク製-

美品!LINDBERG ◇ MDSCA デンマーク製-

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MDSCA AIR

美品!LINDBERG ◇ MDSCA デンマーク製-

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MDSCA AIR

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MDSCA AIR

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MDSCA AIR

ヤフオク! -「~リンドバーグ」(めがね、コンタクト) の落札相場・落札価格

Yahoo!オークション -「リンドバーグ メガネ」の落札相場・落札価格

ヤフオク! -「眼鏡 リンドバーグ」の落札相場・落札価格

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MORTEN

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MORTEN

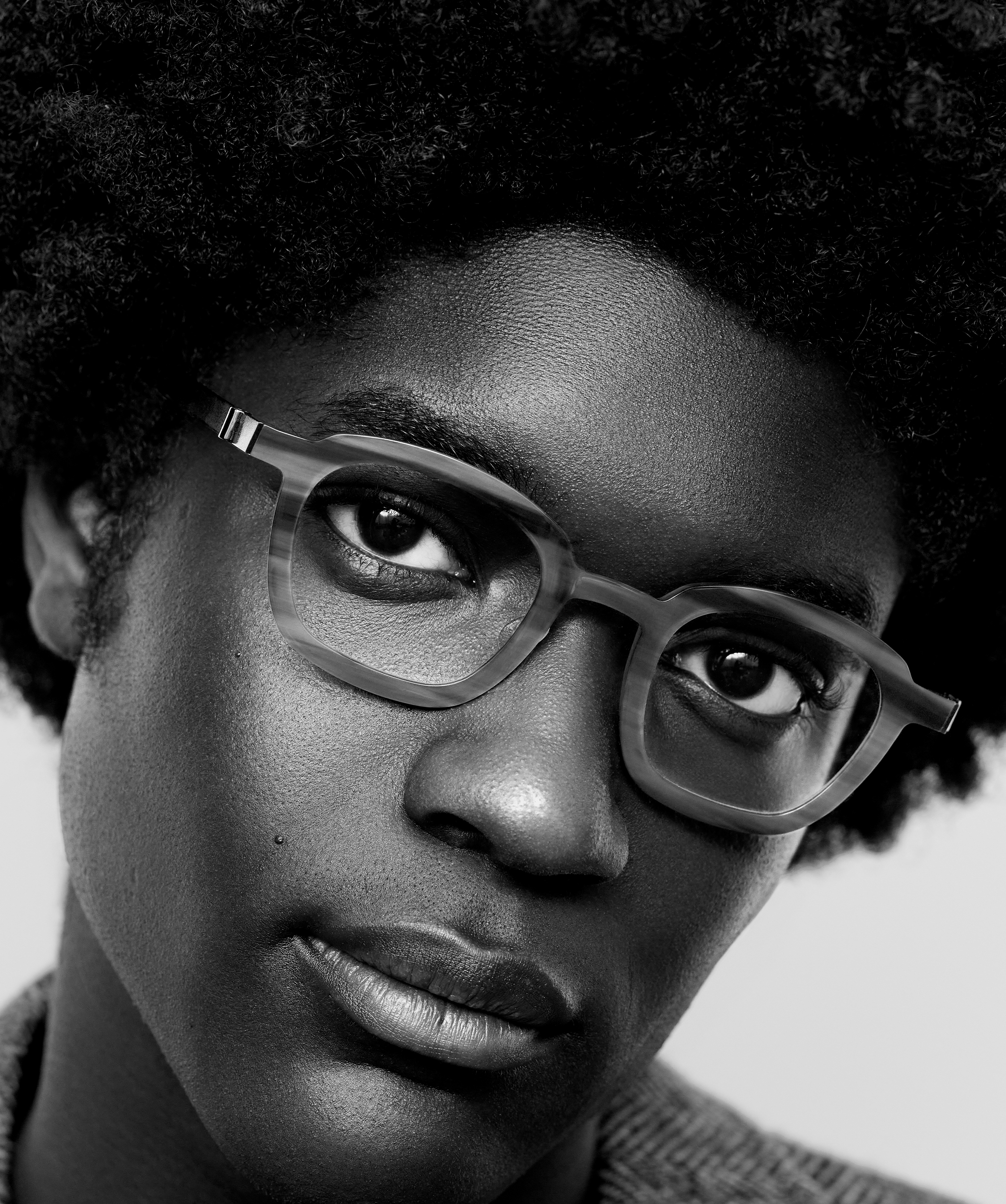

LINDBERG eyewear-オリジナルのデンマークデザイン

美品!LINDBERG ◇ MDSCA デンマーク製-

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MORTEN

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MORTEN

60%OFF】 Vis Viva 01 サングラス/メガネ - oware.co

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MORTEN

爆売り! ペルソール PERSOL サングラス サングラス/メガネ

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MDSCA AIR

ヤフオク! -「眼鏡 リンドバーグ」の落札相場・落札価格

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ AIR

Yahoo!オークション -「リンドバーグ メガネ」の落札相場・落札価格

美品!LINDBERG ◇ MDSCA デンマーク製-

デンマークのメガネブランド、LINDBERG | O'Bon Paris | Easy to be

Yahoo!オークション -「リンドバーグ メガネ」の落札相場・落札価格

LINDBERG eyewear-オリジナルのデンマークデザイン

真作保証 平山郁夫 「 太湖 に浮かぶ 漁船 」扇面 陶板画 落款有 中国-

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ MORTEN

デンマークのメガネブランド、LINDBERG | O'Bon Paris | Easy to be

未使用】 本鼈甲眼鏡 上トロ甲 極厚眼鏡フレーム 希少 買取り実績 56.0

New Brand LINDBERG(リンドバーグ) “n.o.w(ナウ) シリーズ”のご

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ AIR

デンマークのメガネブランド、LINDBERG | O'Bon Paris | Easy to be

LINDBERG eyewear-オリジナルのデンマークデザイン

バーバリーブルーレーベル レザーベスト-

ミニマルなヘキサゴン型(6角形型)LINDBERG(リンドバーグ)”RIM RUI” D

最高峰メガネ※定価7万※デンマーク製*LINDBERG・リンドバーグ AIR

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています