新品 レンズ無料 ヴィンテージ オールドフォーカルズ クラウンパント レスカ好き

(税込) 送料込み

商品の説明

度付きメガネ【フレーム+度付きレンズ+ケース 眼鏡セット】

近視 乱視 遠視 老眼 伊達 処方箋 に対応。

【OLD FOCALS オールドフォーカルズ】

カリフォルニア州ロサンゼルスはパサデナにあるヴィンテージショップ Old FocalsのオーナーRuss Campbell氏が手がける自社ブランド。

ヴィンテージフレームからインスパイアされたコレクション。アメリカ製でのオールハンドメイド。

●型番:bootlegger

●カラー:グレースモーク

●デザイン:クラウンパント

●サイズ:横幅44mm 鼻幅25mm テンプル長135mm 縦幅39mm

●表記サイズ:44口25

●定価:38,(税込)

●状態:新品・未使用

●付属品:専用ケース・眼鏡拭き

●フレーム製造:USA

【レンズ】

●種類:HOYA薄型レンズ

●素材:プラスチック

●装備:UV400カット

●仕様:キズ防止コート ちらつき防止コート 水やけ防止コート

●定価:15,

【無料レンズの度数について】

レンズの製作範囲内の度数であれば製作可能です。

ご購入の前に「コメント欄」からレンズ度数をご明記下さい。

度数の対応範囲は下記を参照下さい。

近視度数 (S)-0.25 ~ (S)-6.00

乱視度数 (C)-0.25 ~ (C)-2.00

老眼度数 (S)+0.25 ~ (S)+4.00

伊達眼鏡 (S)±0.00

※「老眼鏡」の場合は詳しいデータは必要ありません。

+0.25~+4.00の16度数からお選び下さい。

+0.25 +0.50 +0.75 +1.00 +1.25 +1.50 +1.75 +2.00

+2.25 +2.50 +2.75 +3.00 +3.25 +3.50 +3.75 +4.00

◉ブルーカットは有料にて対応可能です。※3,の加算

◉必ずご購入前に、レンズ度数をコメント欄からお問い合わせ下さい。

✤その他のお品はこちら↓↓↓

#RUSTYNAIL出品

#RUSTYNAILオールドフォーカルズ

Lesca

オールドフォーカルズ

レスカ

コルビジェ

クラウンパントンクラウンパント

フレームカラー...グレー

種類...メガネ、ケース付属

レンズ特徴...度なし、度入り/度付き、老眼鏡商品の情報

| カテゴリー | メンズ > 小物 > サングラス/メガネ |

|---|---|

| 商品の状態 | 新品、未使用 |

入荷しました オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

新品 レンズ無料 ヴィンテージ オールドフォーカルズ クラウンパント

入荷しました オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

2023年最新】コルビジェ メガネの人気アイテム - メルカリ

オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達|PayPayフリマ

入荷しました オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

入荷しました オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

NEWレンズ 無料 近視 乱視 老眼 伊達 ビンテージ クラシッククラウンパント - 通販 - gofukuyasan.com

オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

高級素材使用ブランドLescaレスカ PICAクラウンパント 黒縁眼鏡 メガネ

高級素材使用ブランドLescaレスカ PICAクラウンパント 黒縁眼鏡 メガネ

レスカ好きに レンズ無料 近視 乱視 老眼 伊達 クラシック ビンテージ

値下げ オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達-

人気の黒 オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

残り少 オールドフォーカルズ Rocker ハンドメイド レンズ無料 | en.rs

高級素材使用ブランドLescaレスカ PICAクラウンパント 黒縁眼鏡 メガネ

売買 入荷しました オールドフォーカルズ レンズ無料 人気の黒 kids

残り少 オールドフォーカルズ Rocker ハンドメイド レンズ無料 | en.rs

売買 入荷しました オールドフォーカルズ レンズ無料 人気の黒 kids

残り少 オールドフォーカルズ Rocker ハンドメイド レンズ無料 | en.rs

OG×OLIVER GOLDSMITH/オリバーゴールドスミス/ハーフリム 出産祝い

高級素材使用ブランドLescaレスカ PICAクラウンパント 黒縁眼鏡 メガネ

NEWレンズ 無料 近視 乱視 老眼 伊達 ビンテージ クラシッククラウン

人気の黒 オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

人気の黒 オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

ケーズデンキ 株主優待 3万円分 | hartwellspremium.com

レスカ好きに レンズ無料 近視 乱視 老眼 伊達 クラシック ビンテージ

値下げ オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達-

オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達|PayPayフリマ

NEWレンズ 無料 近視 乱視 老眼 伊達 ビンテージ クラシッククラウン

売買 入荷しました オールドフォーカルズ レンズ無料 人気の黒 kids

レスカのヴィンテージ クラウンパント | HUES 福岡セレクトショップ

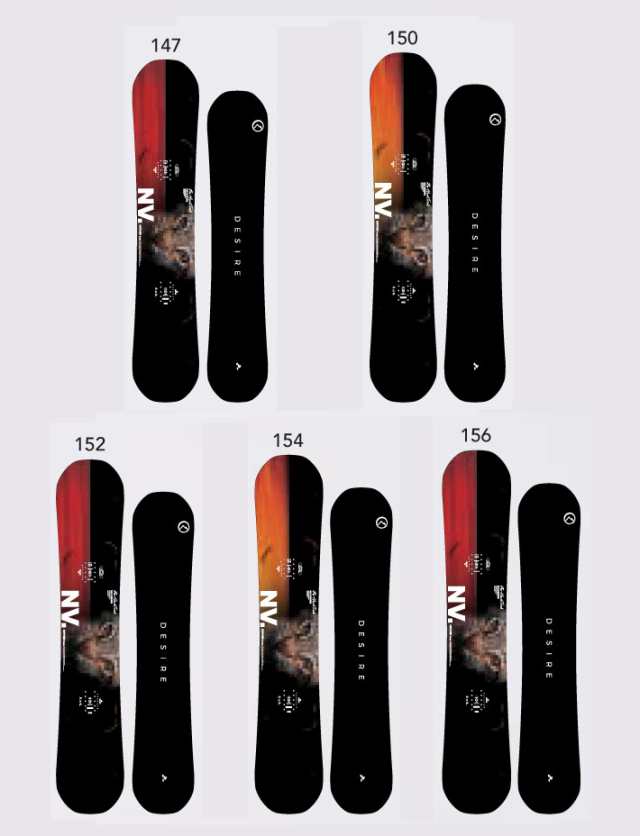

November DESIRE 147 / 17-18 グラトリ | hartwellspremium.com

OG×OLIVER GOLDSMITH/オリバーゴールドスミス/ハーフリム 出産祝い

NEWレンズ 無料 近視 乱視 老眼 伊達 ビンテージ クラシッククラウン

人気の黒 オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

新品 クラシック オーバル 近視 伊達 復刻版 老眼 レンズ無料 乱視

レスカ好きに レンズ無料 近視 乱視 老眼 伊達 クラシック ビンテージ

人気の黒 オールドフォーカルズ レンズ無料 近視 乱視 老眼 伊達

売買 入荷しました オールドフォーカルズ レンズ無料 人気の黒 kids

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています